Are you in debt?

Are you struggling to make your minimum payments?

Is compounding interest making it impossible to pay the debt off?

Would you like to be debt free?

We can help.

How we Help

Overwhelmed by debt? You don’t have to face it alone. Our expert consultants are here to guide you through debt management and find the best solution for your unique situation. Whether it’s consolidating debt or exploring other options, we’re here to help. Take control of your finances and start your journey to a debt-free future with us. Your first step towards financial freedom begins here.

We offer a variety of services to help you find the best path to financial freedom. Our most popular options include consumer proposals through a Licensed Insolvency Trustee, debt consolidations, bankruptcy assistance, and home lines of credit. Our expert consultants are here to guide you to the program that fits your unique needs, providing support every step of the way. Our goal is to get you out of your financial troubles and ensure you have the tools to build a future for you and your family.

Our Services

Trustee Relationship:

First Step Debt Solutions(FSDS) has a network of Licensed Insolvency Trustees (LIT), Mortgage Brokers, Vehicle Financers that we have vetted to ensure that you will receive good service and be treated kindly and respectfully. Everyone plays different roles; the LIT administers the proposal and handles all the regulatory aspects, your FSDS advocate solely looks after your interests and is responsible for providing a personalized financial rehabilitation and credit rebuilding plan. Everyone is working together to achieve the ultimate goal – getting you the fresh start you deserve.

Consumer proposal:

A consumer proposal is a legally binding agreement to consolidate and repay a portion of your debt over up to five years, negotiated by an LIT. It allows you to keep your assets, stop interest, and protect you from creditor legal actions, offering a manageable alternative to bankruptcy.

Bankruptcy:

Bankruptcy is a legal process that helps individuals eliminate most debts or create a repayment plan based on their financial situation. Administered by an LIT, it provides relief from creditor actions and allows for a fresh financial start, though it significantly impacts your credit score and remains on your credit report for several years.

Home refinancing:

Home refinancing involves replacing your existing mortgage with a new one, often to secure a lower interest rate, reduce monthly payments, or access equity. This process can help improve your financial situation by lowering your overall debt costs or providing funds for other needs.

Vehicle financing:

Finding the right financing can be challenging. For over 10 years, our network across Canada has been helping clients secure vehicles at reasonable interest rates for their families. Let us assist you in navigating your financing options and finding the best solution for your needs without having to step inside a dealership.

Client Care:

Upon successfully eliminating your debts, our personalized client care plan steps in to help restore your credit health.

In Canada, understanding the importance of credit in wealth accumulation is key. However, many are unaware of the time and effort required to repair damaged credit without the right guidance and resources.

Our client care programs are crafted to provide you with the necessary knowledge and tools to rebuild your credit steadily. We’ll work closely with you to develop a clear path towards achieving a strong credit score, ensuring that you’re equipped to navigate the complexities of credit rebuilding with confidence.

No Upfront Fees

Free Consultations

No Obligations

Locations

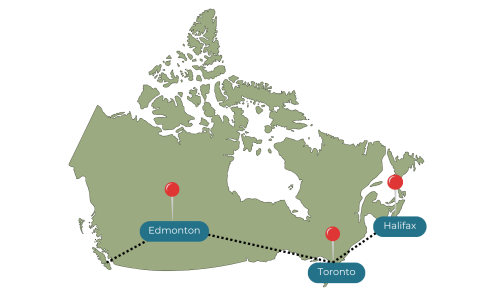

We serve all of Canada through our virtual offices and have physical locations in Toronto, Edmonton, and Halifax. Our Debtor Advocates are available nationwide and familiar with your local area, ready to assist you with scheduled personal appointments.